The foreign trade of Azerbaijan reflects the impact of important reserves of oil and natural gas. Azerbaijan also possesses mineral resources such as iron ore, iron pyrites, zinc, copper, cobalt and precious metals. Although the dry climatic conditions are generally not favourable to agriculture, extensive irrigation systems permit cultivation of cotton, grapes, tea, citrus fruit and grain. The manufacturing sector, particularly the heavy industrial activities created during the Soviet era, has been struggling to adapt to new economic conditions.

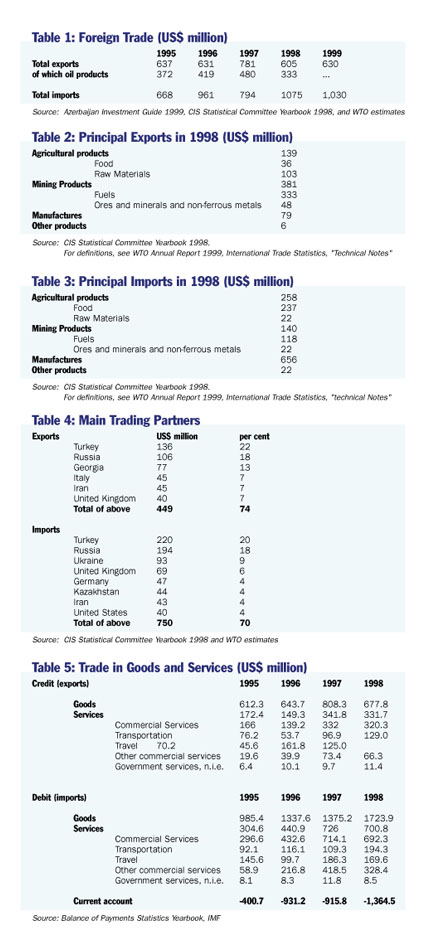

From 1995 to 1998, Azerbaijan recorded steadily rising deficits in its merchandise trade. Exports are dominated by crude oil and refined products (diesel, kerosene and gasoline), which account for two thirds of export revenue. A significant recovery in oil production in 1998, hence permitting increased exports of petroleum, coincided with declining world market prices for oil. Further increases in crude production in 1999 and higher prices had a positive impact on Azerbaijan's export figures. However, Azerbaijan's ability to export crude oil is constrained by the limited capacity of the Baku-Supsa (Georgia) pipeline, as well as disruptions in the normal export route through Russia.

The trade deficit narrowed in 1999, but nevertheless amounted to US$400 million. Imports fell - measured in US dollars - in part in response to the devaluation of the manat in June, as well as due to the depreciation of the currencies of Azerbaijan's main local trading partners. A significant reduction in investment in the oil sector also led to reduce imports of capital goods. In trade in agricultural products, Azerbaijan is a net importer of food. The deficit in trade in food products amounted to US$ 200 million in 1998 and was only partially offset by exports of cotton and tobacco.

Direction of trade

Since restoration of independence, Turkey has become Azerbaijan's most important trading partner, accounting for 22 percent of exports and 20 percent of imports in 1998. Trade with Russia remains significant, with imports worth US$194 million and exports of US$106 million in 1998, but the importance of Russia in Azerbaijan's foreign trade has declined steadily in recent years. Azerbaijan imports transportation spare parts and wheat from Russia, while electricity, tobacco and cotton are the main export items. Trade with developed countries such as Germany, the United States, United Kingdom and Italy has been rising, a trend which appears to have gained further momentum in 1999. Trade with Iran fluctuates considerably year to year.

One of Azerbaijan's principal challenges is that its main trading partners in the region (Turkey, Russia and Iran) have inherently weak currencies. In the years to come, Azerbaijan must try to avoid a boom in the oil sector, which will result in a significant appreciation of the manat against these currencies. The influx of cheap imports may erode Azerbaijan's manufacturing base unless structural measures are taken to enhance the competitivity of domestic sectors.

Trade in Goods and services

Data based on balance-of-payment statistics indicate a much larger deficit in trade in goods than that recorded by customs. On a balance-of-payments basis, imports of goods exceeded exports by more than US$1 billion in 1998. Azerbaijan also recorded a negative balance on trade in services, thus the deficit on current account amounted to almost US$1.4 billion in 1998, equivalent to one third of GDP. Although precise data is not yet available, the current account deficit narrowed sharply in 1999 as the trade balance improved (for the reasons noted above), and lower investment activity in the oil sector reduced the demand for imported commercial services, including travel and transportation.

The main factor behind Azerbaijan's deficit in trade in goods and services has been the high level of investment undertaken in the petroleum sector in recent years. Foreign investment in this sector has largely financed the trade deficit, therefore, Azerbaijan's level of foreign debt remains low. Although the current high oil prices may offer a windfall gain to Azerbaijan, the current account deficits - if allowed to persist - may need to be debt financed.

flat72.jpg)