flat72.jpg)

Transportation This section contains several articles: Caspian Energy Transportation Infrastructure: The Key to a Bright Future, 2000 Richard Matzke, Vice Chairman, Chevron Companies To obtain the following article, please contact USACC Without question, the Caspian region has an abundance of hydrocarbon resources. The International Energy Agency noted in Caspian Oil and Gas, The Supply Potential of Central Asia and Transcaucasia (Caspian Oil and Gas): "Crude oil exports are expected to be the driving force

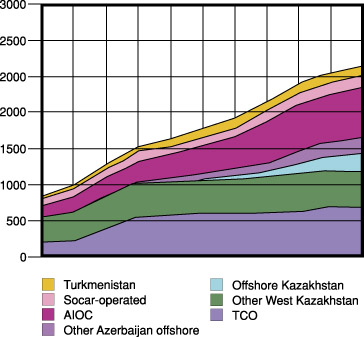

behind the development of the country's (Azerbaijan's) industry and infrastructure. ... a secondary oil equipment and oil service industry should offer ample opportunities for a well-educated work force. Important infrastructure requirements such as the building of pipelines, telecommunications, power plants and petrochemical industries will provide further opportunities." Thus, the implementation of efficient reliable energy transportation infrastructure for Azerbaijan and other Caspian producing states is an essential prerequisite for the economic renaissance of the region. In this paper, we will provide an update on the progress that has been made in developing this required energy transportation infrastructure. As will be clear from a review of the recent progress, investors can now be confident that the full potential of the Caspian states will be realized. Accordingly, the region clearly offers an outstanding opportunity for investors seeking to develop the broad range of other infrastructure projects necessary for the growing economies of the region. The producing states of the Caspian region are linked by a shared history and environment. The leaders of the region have recognized that substantial economic benefits are possible through mutual cooperation in addressing the region's energy transportation issues. The following graph shows International Energy Agency's (IEA) projections of oil production for Azerbaijan, Kazakhstan and Turkmenistan through the year 2010. Source: International Energy Agency: Black Sea Energy Survey, 2000. As impressive as these projections are, many industry experts expect this growth trend to continue well into this new century. An obvious question is whether the necessary energy transportation infrastructure can be implemented in time to convert this potential into reality? We believe the answer is a resounding yes! A brief review of the history of the region provides ample reason to be optimistic for the future of Azerbaijan and neighboring producing states. This is the fourth millennium in which Azerbaijan has been involved in "the oil trade." The earliest record of involvement goes back to 700 - 600 BC, when oil from the Apsheron Peninsula was transported all the way to India for heating, lighting and medicinal purposes. In the twelfth century, Marco Polo noted in his travels in the region that there was a spring, which contained oil that was not edible. He also observed that this oil was highly valued and was traded to neighboring states. The Apsheron Peninsula was one of the earliest regions in the entire world in which oil was commercially developed on a large scale. Between 1600 and 1806, there is record of a number of wells which were dug by hand. In the mid-1800s, the oil industry in Azerbaijan was in full swing. The industry can reasonably claim a series of firsts, specifically, those related to lubricating oils, drilling technology, "distillation factories," bulk marine transportation, etc. Starting in 1873, the region developed into an important refining center. Then, as now, there was an urgent need to identify and implement energy transportation solutions. In 1874, the Nobel Brothers Association began constructing oil pipelines to connect the oil fields with the refineries in Baku. Initially, oil and products were shipped in barrels from Baku to Astrakhan, a city on the North Caspian Delta and then by barge via the Volga River. In 1877, the world's first steel tanker was constructed to transport kerosene on the Caspian Sea. Also, a number of pipelines were constructed between the Sabunchi fields and the refineries in Baku. The wisdom of having a diversity of routes to access favorable markets was recognized even then. In 1879, the Sabunchi -"Black City" Railway was completed, followed in 1883 by the construction of the TransCaucasian Railway between Baku and Batumi (Georgia). The railway was developed primarily to transport oil by rail tank cars to the Port of Batumi for delivery to international markets. The mountainous terrain limited the flow of crude via rail and so the construction of the Baku-Batumi pipeline began. During the early history of the oil industry, Azerbaijan accounted for almost 50% of world crude production.

Azerbaijan became the center for the manufacturing of oil and gas equipment for Russia and the Caspian and pioneered many technical innovations that were adopted internationally. In the early portion of the Soviet era, Azerbaijan accounted for a majority of the oil production of the USSR. Oil output in Azerbaijan in 1940 constituted 70% of the total USSR crude production. Azerbaijan continued to develop as a major refining center and as the base for the manufacturing of oil field and service equipment for the entire Soviet Union. It also developed as an important academic and technical research center for the oil industry. During the Soviet era, planning for the oil sector was managed on a centralized basis. Decisions with respect to all aspects of the oil industry (i.e. investment, pipeline routes and crude flows) were made by the central government. In the post war era, the focus of the Soviet oil industry turned to the Volga Basin and then subsequently to West Siberia. The major discoveries in these regions were exploited to meet rising demand. The crude oil pipeline system for the Soviet Union was developed as a "unified technologically integrated crude oil transportation system" to serve the needs of the Soviet Union as a whole. The construction of the pipeline that would eventually link Baku to Novorossiysk began in the 1960s with the construction of a segment between Tikhoretsk and Malgobek, a location near Grozny. Originally, the pipeline was built to deliver 7 mmta of crude from the Malgobek fields to Tikhoretsk. This pipeline segment was put in operation in 1969. In 1974, the pipeline was refurbished and reversed to deliver oil to the refineries in Grozny. In 1979, because of the shortfall of feedstock at Grozny and the anticipated expansion of service to the Baku refineries, the pipeline throughput capacity was increased to 17 mmta. The maximum throughput achieved on this pipeline was 13 mmta in 1989. In 1981, a 601-km pipeline was constructed from near Grozny to Baku. The pipeline was built to deliver West Siberian and Dagestan crude oils (Shemkhal-Bulak, Mahachkala and Izberbash fields) to the refineries of Azerbaijan. The design capacity of this pipeline was 9 mmta. In the 1980s, the Ministry of Oil of the Soviet Union's focus turned to new development opportunities. These included Timan Pechora, East Siberia and once again, the Caspian region. In 1984, a 40-inch diameter pipeline system was constructed just North of the Caspian Sea to transport production from Kazakhstan to Grozny. This pipeline was approximately 800-km long and 40" in diameter. (Part of the pipeline is now incorporated as part of Caspian Pipeline Consortium

(CPC) system). At this point in time, there was no pipeline outlet in place to transport Azerbaijani production to export markets. A period of transition throughout the former Soviet Union began in 1991 that is unparalleled in the history of the world in terms of scope and complexity. This period, in hindsight, is one of great accomplishment for each state in the region! New public and private institutions were built; legal regimes were adopted; and international treaties and bilateral agreements were negotiated. Almost every aspect of the economy was restructured, including the development of national currencies and banking systems. And these are only a few of the actions required and taken. Those of us who had the benefit of observing this process first hand have nothing but great respect for the stamina, wisdom and leadership demonstrated during this period.

An important priority for the newly independent states was to address concerns of domestic energy supply and the development of their own hydrocarbon resources. Given the recognized potential of the Caspian region, the Caspian states were able to attract widespread interest from international oil industry from almost all parts of the globe. A number of major agreements were signed. Chevron and partners signed licenses on the development of the Tengiz field in Kazakhstan in 1993. In 1994, Azerbaijan International Operating Company (AIOC), a consortium of 10 major international oil companies and SOCAR, signed a PSA agreement to develop the Azerbaijani, Chirag and deep-water portion of Gunashli fields in the Azerbaijani sector of the Caspian Sea. This transaction has been referred to as "the deal of the Century." Azerbaijan was successful in negotiating 19 PSA agreements with major regional and international oil companies in relatively quick succession. The IEA in its Caspian Oil and Gas report noted that Azerbaijan is expected to have the highest share of foreign investment in proportion to GDP of any of the regional states. As a result, the energy sector is expected to grow to 30 % of GDP by 2020. A significant number of PSA agreements were also negotiated by the neighboring states with international oil companies, including the major exploration agreement offshore Kazakhstan (Kashagan). The serious business of addressing energy transportation infrastructure requirements began in earnest. In 1991, the only export route from the Caspian states to non-Soviet markets was via the Atyrau Samara pipeline segment. From Samara, it was possible to access all of the export outlets with which Transneft (the successor in the Russian Federation to Glavtransneft) interconnects. Although the capacity of this line was approximately 10 mmta, a majority of capacity was tied up in barter trade, and in 1991, only 1.5 mmta of the capacity was available for export to "hard currency" markets. As noted previously, the crude oil pipeline serving Azerbaijan was designed to transport crude in the direction of Baku. The Caspian Pipeline Consortium (CPC) was initially formed in June of 1992 with a goal of providing this urgently needed export link for Tengiz and other fields in Kazakhstan. Progress was delayed because of disputes on the structure of the project and other commercial matters. In 1996, the project was restructured to allow for the ownership to be divided between the participating governments of Russia, Kazakhstan, the Sultanate of Oman and a consortium of domestic and international companies, including Chevron, LUKARCO, Rosneft-Shell, Mobil, Agip, BG, Amoco - Kazakoil and Oryx. On May 16, 1997, the restructuring was completed, and the newly constituted consortium committed to construct a 1,500 kilometer pipeline between Russia's Black Sea Coast and oil fields in Northwestern Kazakhstan, including the Tengiz field. Under the terms of the agreement, the oil producers in the consortium have the responsibility to finance the construction costs. As currently planned, the pipeline will become operational in mid-2001. The CPC route extends from Kazakhstan, around the northern shore of the Caspian Sea through Russia to the Port at Novorossiysk. The route originates from the Tengiz field and reaches the Black Sea via Atyrau, Komsomolskaya, and Kroptkin, terminating at the at the new Yuzhnaya Ozerevka terminal near the Port of Novorossiysk where the crude will be loaded on to tankers using two SPMs. The design capacity for stage one will be 28.2 mmta, with an expected ultimate system capacity of 67 mmta. At the outset of the project, the CPC general director stated, "The pipeline is a win-win project for Russia and Kazakhstan. Along with the revenues generated from the sale of crude oil on the international market, the pipeline will create tax revenues, new jobs during construction and after the pipeline is operational, as well as the transfer of new technologies." History has already proven him correct. The $ 2.5 billion project includes the rehabilitation and upgrading of existing pipeline facilities, and the installation of a new pipeline and infrastructure including: pump stations, valve stations, cathodic protection, a supervisory control and data acquisition system (SCADA) to automatically monitor the pipeline, incorporating both a satellite and a microwave telecommunications system, storage tanks, volume metering and custody transfer facilities, and power supply systems. A new marine transportation terminal with two single-point mooring (SPM) facilities is being constructed at Yuzhnaya Ozerevka. The Early Oil Project, as initially contemplated, was to include the refurbishment of the Chirag-1 platform, the construction of a new onshore terminal at Sangachal and a 230 km subsea pipeline system, as well as the implementation of a northern and western export pipeline route to transport early oil production to world markets. The Northern route through the Russian Federation involved the reversal and rehabilitation of the existing pipeline linking Baku and Tikhorestsk. From Tikhoretsk, the early oil could be transported to the Port of Novorossiysk on the Black Sea. The original plan in establishing a western route through Georgia was to refurbish existing pipeline segments in the region and to construct the necessary pipeline links to interconnect these systems so as to create an export link to the Port of Supsa on the Black Sea. As noted previously, an existing pipeline was already in place between Tikhoretsk to Baku. Azerbaijan entered into an intergovernmental agreement with the Russian Federation to reverse the line and to transport on an expanding scale Azerbaijani production to the Port of Novorossiysk. The Northern route became operational on October 25, 1997, and the first tanker lifted 80,000 tons of AIOC-produced oil on March 24, 1998. The Northern route experienced a number of interruptions, a few of a technical nature, but mainly caused by security breaches on the pipeline in the territory of Chechnya. Deliveries on the northern route were suspended in the fall of 1999.

In January of this year, Transneft proceeded with the construction of a new segment that would enable the transportation of crude oil from Baku to Novorossiysk to resume. The new segment is 311-km between Sulak and Trudovoya. The pipeline is scheduled to be placed in service in April 2000, and when completed, it will have a capacity of 6 mmta. In addition, Transneft has begun the construction of an 18-km segment from the Port of Mahachkala. This segment will enable crude

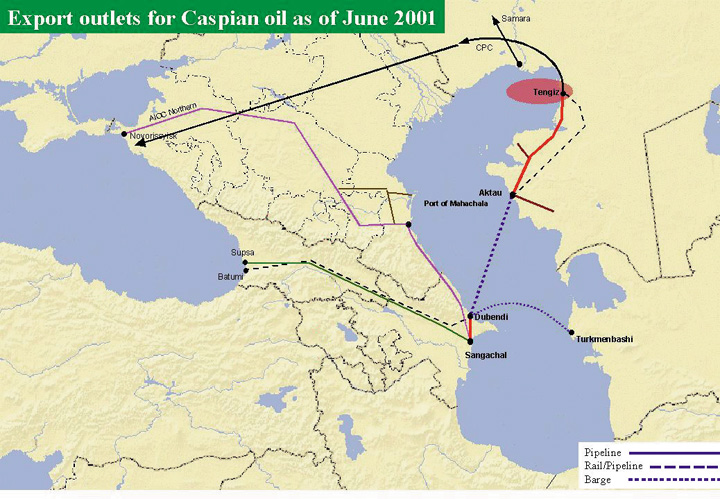

deliveries to the Port to be directly connected to the pipeline to Tikhoretsk. This section will have a capacity of 5 mmta and is intended to serve Southern Caspian and Kazak producers. Transneft announced that the planned tariff for this route will be $8 per ton for deliveries to Novorossiysk. The second early oil route originates at the Sangachaly Terminal near Baku and ends at the Port of Supsa on the Georgian Coast. The first crude deliveries on this line occurred in April of 1999. The pipeline has an initial capacity of approximately 6 mmta. At the terminus, tanker loading takes place via a single point mooring system. The total distance of this route is approximately 850-kilometers. The pipeline is primarily used by the AIOC consortium, which operates the Guneshli-Cirag-Azerbaijani (GCA) field complex offshore Azerbaijan. AIOC had hoped to take advantage of existing infrastructure in place in constructing this pipeline. However, because of the condition of the existing pipelines, a decision was made to install new pipe along the entire route. With the addition of pumping capacity and some limited looping, the Supsa line could readily be expanded to over 10 mmta (200,000 b/d). Chevron pioneered the re-establishment of the historic Eurasian transit route through Georgia. This combination of marine - rail - pipeline transportation system was placed in service in 1997. Given the limits of available export pipeline capacity to the north from Kazakhstan, TengizChevroil had to choose between slowing down field development activities in Tengiz or finding alternative export options. TengizChevroil chose the later. By taking advantage of existing rail and pipeline infrastructure, we implemented the Dubendi-Batumi export link. This system has a current capacity of 3.5 mmta. With minimal investment, the capacity of this rail pipeline network could be expanded to approximately 7 mmta. The following map shows the pipelines in place or in process as the region enters the new millennium. These facilities can be readily expanded to over 2 million barrels per day in relatively short order. The following table shows the projected capacity of crude oil pipelines available for Caspian exports in 2001, and also future projected capacity if these facilities are expanded to their full potential.

In addition to the pipeline solutions listed above, there are other

possible modes of transportation and commercial arrangements. Caspian

oil has been exported to Asian markets via swaps both via Russia

and Iran. For example, TengizChevroil conducted a pilot transaction

in which TengizChevroil production was exchanged for West Siberian

production, which in turn was delivered to a railhead in eastern

Kazakhstan to be transported to China. In addition to exchanges,

rail and marine options also exist. With respect to the implementation of pipeline infrastructure,

this past decade has been one of great accomplishment for the Caspian

region. At the start of the decade, the Caspian region had less

than 2 mmta of usable pipeline access to world markets. By the middle

of next year, there will be over a million barrels per day of crude

oil export pipeline capacity in place. Further, the capacity on

these pipeline facilities could be readily increased on an incremental

basis to over 2 million barrels per day. Indeed, a solid foundation

has already been laid, both in terms of infrastructure and experience,

to realize the potential cited by IEA. Progress and prosperity will

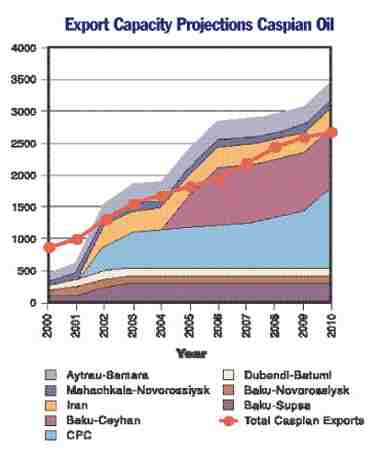

surely follow for the region! The following graphic compares projected regional crude oil production

and potential pipeline capacity in place through 2010. As this graphic shows, even before the construction of the main

export oil pipeline (MEOP) substantial capacity is in place that

can be readily expanded to harvest the regions vast oil resources.

Not every pipeline route in this chart will be expanded to its full

potential, and it is possible that certain pipelines may not be

viable alternatives for specific shippers.None the less, this chart

provides ample evidence that the "drought" in export access in the

Caspian will soon be over. This should encourage and stimulate substantial

economic growth and development in the region. An important question

being asked by investors looking at infrastructure opportunities

in the Caspian has been- can the progress of the past decade be

sustained and can investors be confident that as new oil reserves

are discovered that the additional required pipeline capacity will

be implemented in a timely and efficient manner? We are confident

the answer is a resounding yes! We base this answer on the recent

developments mentioned above and the fundamental conditions in place

that facilitate the implementation of major cross border pipeline

projects.

With respect to the development of a main export pipeline from

the region, at The Organization for the Security and Cooperation

in Europe (OSCE) summit in Istanbul on November 18, 1999, Turkey,

Azerbaijan and Georgia signed a joint declaration on the construction

of a Baku Ceyhan crude oil export pipeline. The Istanbul Declaration

calls for the commencement of construction of this pipeline beginning

in 2001 with completion in 2004. The signatory states and AIOC have

set up an implementation committee to develop a financing plan and

to address design and engineering details.

The Baku Ceyhan pipeline is approximately 1,700-km in length and

would transit Azerbaijan, Georgia and Turkey with the terminus at

the existing Port of Ceyhan. The proposed capacity of the pipeline

is 900,000 b/d.

There are a number of important factors of note on this route -

international treaties and intergovernmental agreements (including

the Istanbul declaration) are in place (just recently the Turkish

parliament joined the prior action of the parliaments of Azerbaijan,

Kazakhstan and Turkmenistan and ratified the Energy Charter Treaty);

Turkey is a rapidly growing energy market; the route bypasses the

Bosporus Straits and Dardinelles; and it utilizes existing infrastructure

at the Port of Ceyhan. Further, Turkey has indicated that it is

prepared to guarantee the cost of construction of the Turkish portion

of the route.

To be sure, as our experience with CPC has shown, implementing

major cross border pipeline projects in this region is not as simple

as drawing a pipeline route on a map. It is a very complicated,

difficult and demanding process. There are no shortcuts! It takes

regional cooperation, careful planning, thorough study and lots

of hard work. Appropriate international treaties and intergovernmental

agreements are necessary. Territorial disputes, such as the delineation

of Caspian Sea boundaries, must be resolved. A suitable legal and

tax regime must be in place in each of the sovereign states and

jurisdictions transited. Given the size and scope of the MEOP, special

legislation will likely be required in each host country.

All of the conditions necessary to attract capital on favorable

terms must be in place including: support of producers and credit

worthy parties; all necessary contracts and agreements; a sound

organizational structure; and favorable economic fundamentals (supply

and demand issues and other market and competitive considerations).

Risk factors must be carefully considered and mitigated (environmental

hazards, volatile world energy markets, etc.). Rights of way must

be secured. Security issues must be studied and resolved. This is

only a partial list of the requirements. The tasks involved can

seem overwhelming, but the lesson of CPC is that if the sponsors

and the host governments proceed step by step in a systematic, cooperative

and organized fashion the challenges can be overcome!

For the CPC project, this process took over 10 years. Even then,

the process was expedited by the willingness of the producers to

take full responsibility for financing the project. The good news

is the fact that CPC will soon be successfully completed and that

the early oil routes have been implemented demonstrates conclusively

that this can be done. Further, Azerbaijan has available to it the

full benefit of the experience of CPC and the early oil routes,

which should significantly streamline the process. Further still,

the expanded pipeline capacity already in place will provide a basis

for accelerating upstream investment that will in turn provide the

economic drivers for regional infrastructure projects.

Clearly, a very favorable characteristic of the current environment

is the positive and constructive attitude of the Republic of Azerbaijan.

As noted in the previous section, Azerbaijan has followed a wise

and pragmatic approach in implementing the early oil transportation

routes. They recognized the importance of: regional cooperation

(for example, a representative of SOCAR currently serves on the

Energy Charter Secretariat's working group on transit issues.);

involving the private sector actively in the process; utilizing

infrastructure in place; the benefits of the competitive process;

and economic fundamentals (net back value, economies of scale, risk

mitigation, etc.).

Azerbaijan and other regional states are wisely proceeding with

appropriate haste to put a framework in place that would enable

the development of a new major crude oil export pipeline system.

This will enable the project to proceed expeditiously once sufficient

shipper support is obtained.

The Istanbul Declaration has served to stimulate the development

of competitive solutions and proposals. Seen in a market context,

this is a notable development. The fact that this occurred should

rapidly change the impression that the region is and will be severely

limited with respect to export access. Obviously, competition also

has the potential to improve costs of transportation and access

terms. Incremental expansion of capacity encourages the acceleration

of upstream development, which, in turn, provides the critical mass

necessary to support the development of major export pipeline projects.

This, in turn, provides a positive investment climate for the development

of all aspects of the economy. Finally, the presence of competition

provides ample evidence that market economic principles are taking

hold in the region.

The critical step for Baku Ceyhan will be to obtain sufficient

shipper support. Once the economic drivers are firmly in place,

one can have the confidence, given the extensive involvement of

major international companies in the region, that shipper support

will follow. This success has been accomplished through the vision, dedication

and support of regional leaders. The dream of a new Silk Road of

expanded mutual beneficial trade and relationships is destined to

become a reality.

It is very evident that

the Republic of Azerbaijan has and will play a very positive and

constructive role in the development of regional transportation

solutions. The government deserves full recognition not only for

its accomplishments within Azerbaijan, but in promoting cooperation

and trading relationships that emphasize market principles and mutual

benefit. It is time - past time - for the US Congress to respond

and repeal the remaining provisions of Section 907.

|